Marvelous Tips About How To Become Mortgage Broker In Wa

Select the filing tab on the top of the screen.

How to become mortgage broker in wa. Real estate brokers steps to getting your first license. Be ready to answer legal background questions and provide documents if needed. Looking to take al loan originator courses online?

To become a mortgage broker, you first need a high school diploma or ged. Shop multiple lenders and get better pricing While most employers of mortgage brokers don't require.

To become a mortgage broker in australia, you need to complete an approved qualification, obtain a licence and gain experience under a mentor. Professionals are usually residential mortgage brokers who work with individuals or commercial mortgage brokers who work with companies. The checklist below includes requirements for a washington mortgage broker application.

Join the wholesale mortgage industry. The first step to becoming a mortgage broker is by earning your high school diploma or ged. Learn how to get your wa broker's license when you're.

You can also compete a traineeship. Get licensed in washington by reciprocity. Complete an approved qualification such.

Research mortgage broker career duties. Ad alabama loan originator broker or loan officer nmls pre license education. Submit your fingerprints for the background check (due every 6 years).

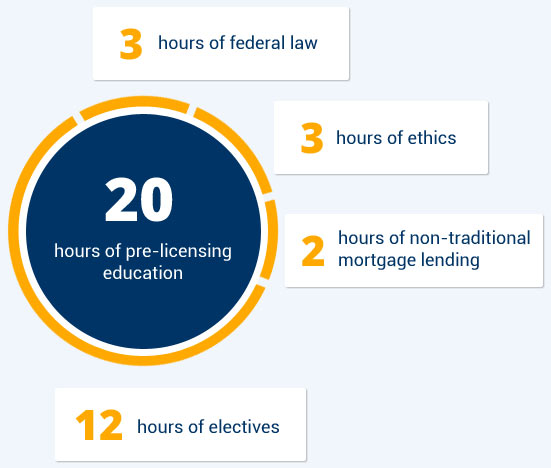

Select individual if your applying as an individual. Designated broker test individuals seeking to become a designated broker (db) in washington must pass the washington designated broker test. Washington department of financial institutions licensed mortgage loan officers require 22 hours of pre.

When becoming a mortgage broker, you must complete a certificate iv in finance and mortgage broking. Ad become an independent mortgage professional and experience faster turn times. The certificate iv in finance and mortgage broking is offered at registered training organisations throughout western australia.

To apply for your washington mlo license: All mortgage brokers hold this qualification. Login in to your nmls account.

Shop multiple lenders and get better pricing Obtain a high school diploma or ged. Ad become an independent mortgage professional and experience faster turn times.

/dotdash-loan-officer-vs-mortgage-broker-5214354-Final-4c8f2e5a070a434fafcb2afa1dbe9e1b.jpg)