Casual Info About How To Build A Swap Curve

V abstract the swap market has enjoyed tremendous growth in the last decade.

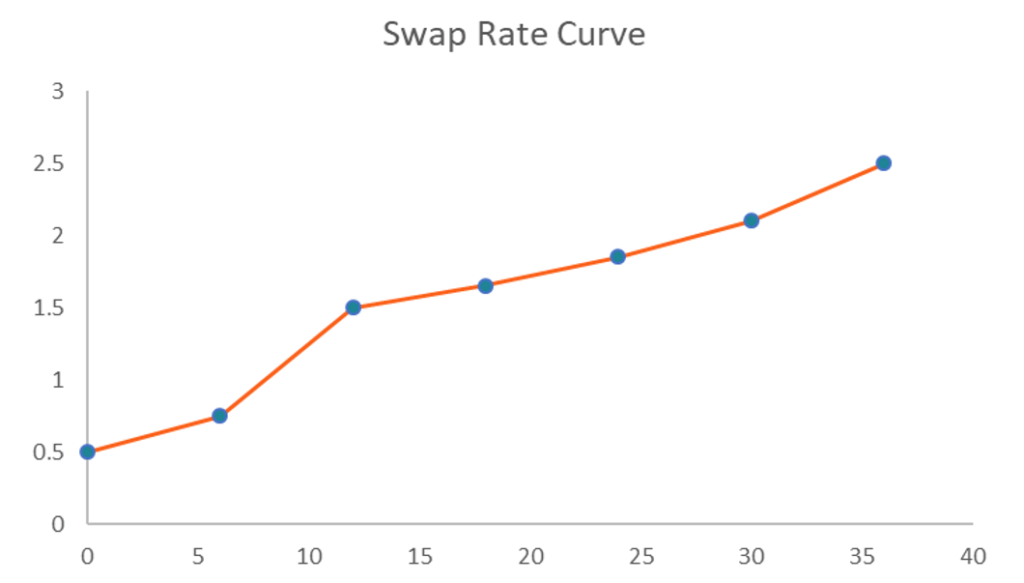

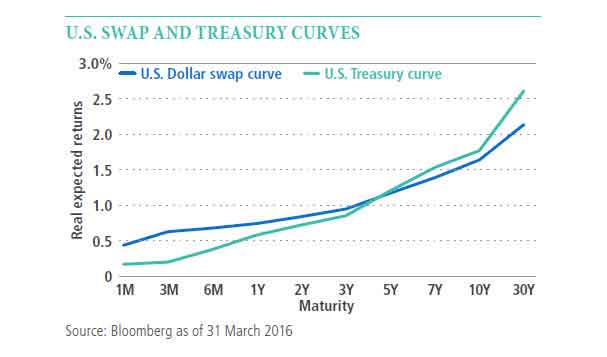

How to build a swap curve. Notice, yield curve inversion in the front of the. Build, visualize, and analyze the swap curve. The table at the bottom supplies the swap rates and consists of two columns.

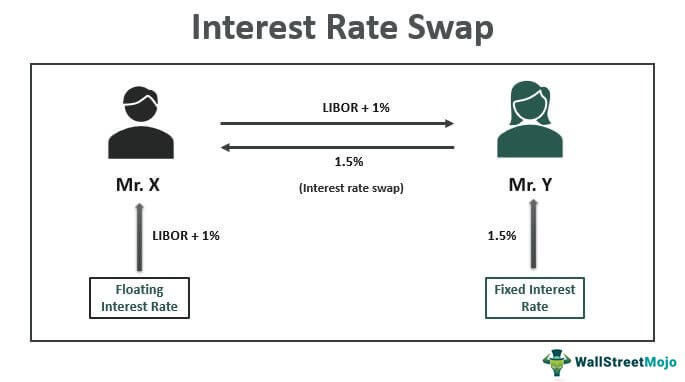

Vanilla irs, where one party pays a fixed coupon. Curve building for a swap. A swap curve is the name given to the swap's equivalent of a yield curve.

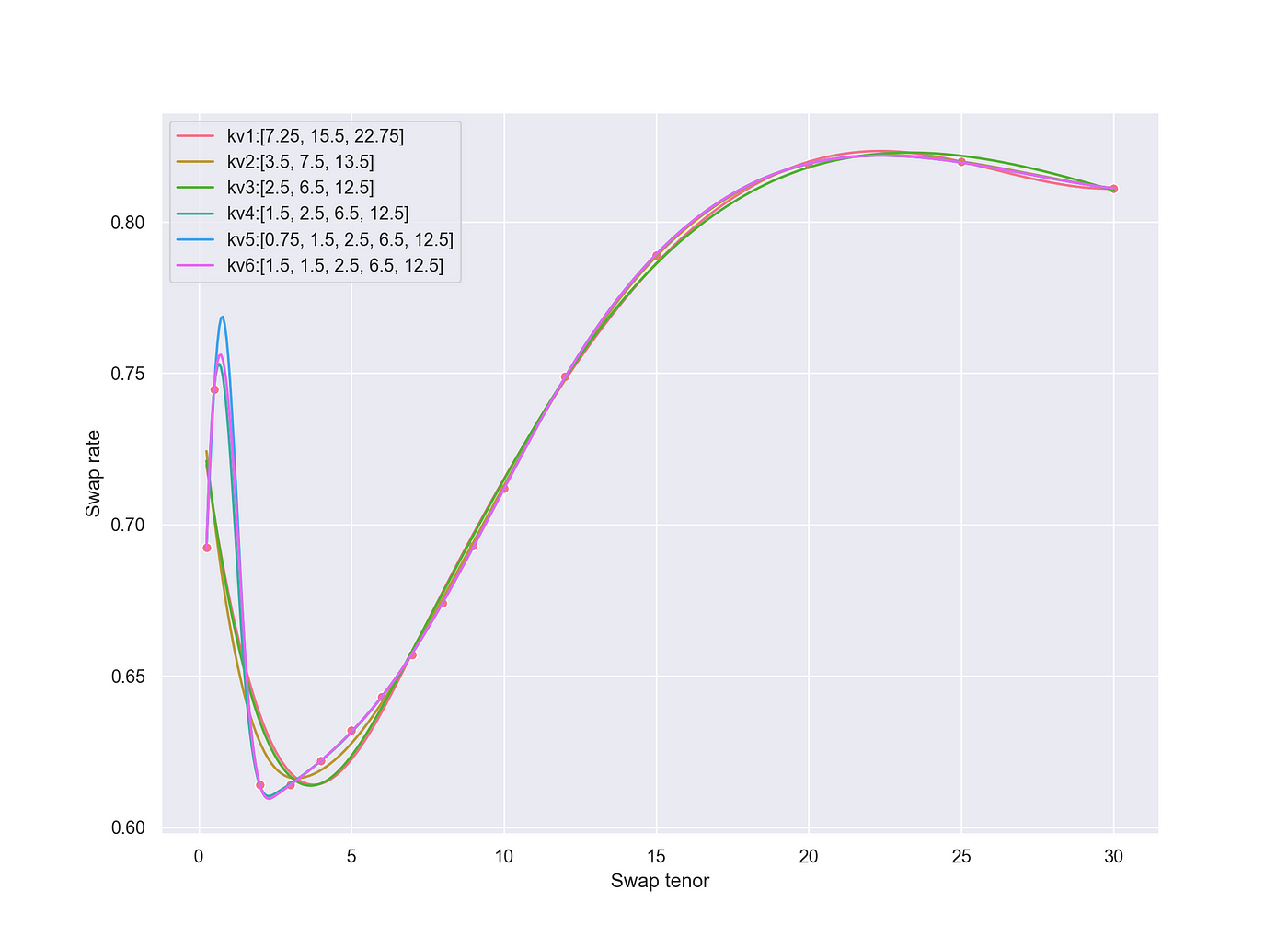

I need some help to figure out the mechanics in building the long end of a swap curve, i have followed a example on how to do it, see this link [url removed, login to view] i need help to finish. Modified 2 years, 8 months ago. Bootstrapping method is used to extract.

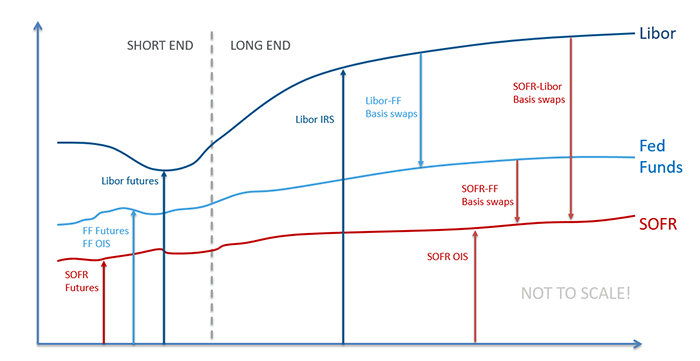

Our white paper, swap curve building at factset: Prior to the gfc, a single yield curve was the output of the process of curve construction. The short end of the forward curve (up to two years) is constructed using sofr future contracts (a liquid futures market reflecting the anticipated sofr on the settlement.

A swap curve identifies the relationship between swap rates at varying maturities. A swap curve is constructed with deposits in the short end until 3m, ir futures in the middle until 2y, and with par swaps until 30 to 50y in the long end. F fe +θ=θ(6) in building the curve in the futures region, formula (4), along with the compounding conversion (6), is applied to each futures period independently, and piecewise forward rates.

The pair ibor index= %gbplibor|6m supplies the conventions of the floating leg index. With government issues shrinking in supply and increased price volatilities, the swap term structure has emerged.

/dotdash_Final_How_to_Value_Interest_Rate_Swaps_Sep_2020-01-4b6f55263e5a41b091bded09d63da811.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Value_Interest_Rate_Swaps_Sep_2020-05-ebe661886e084d879c91c96ab4cbf63b.jpg)