Best Tips About How To Control Accounts Receivable

The accounts receivable reconciliation process should follow these steps:

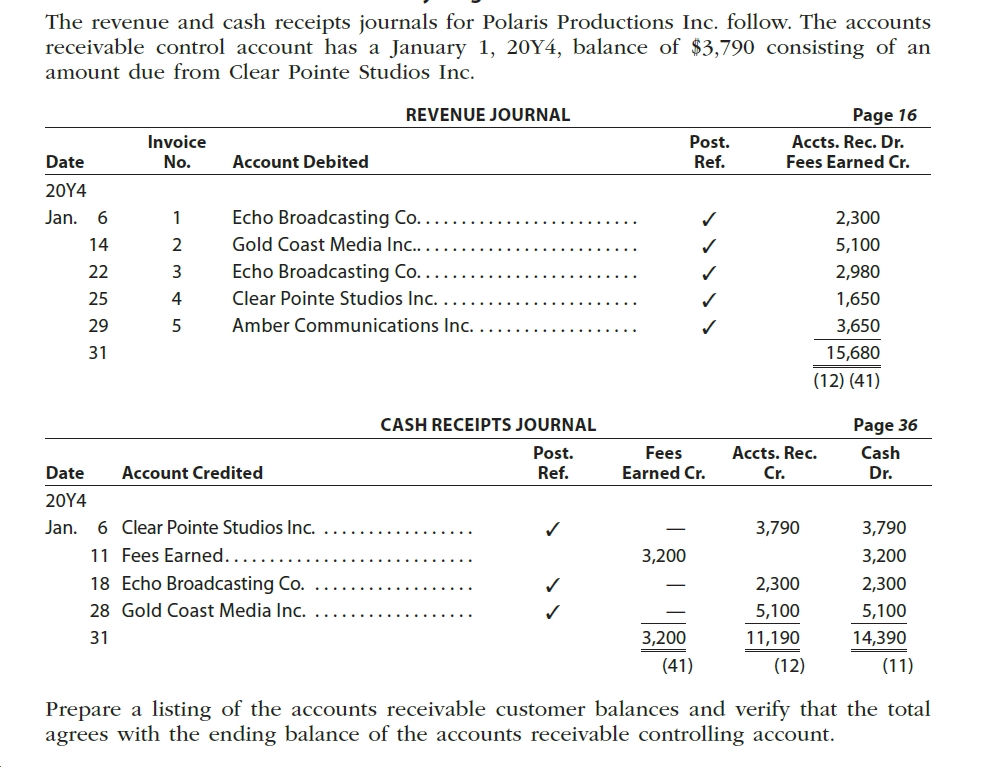

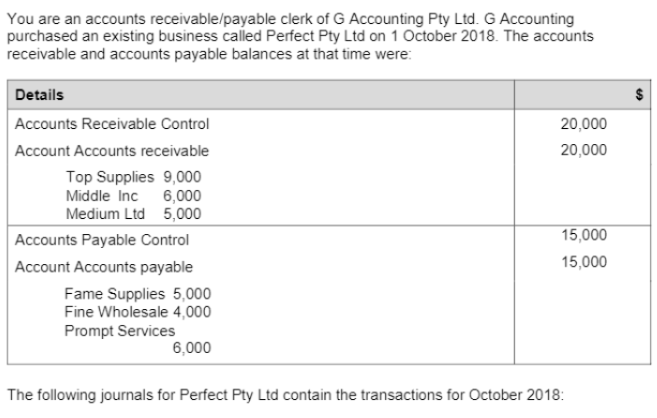

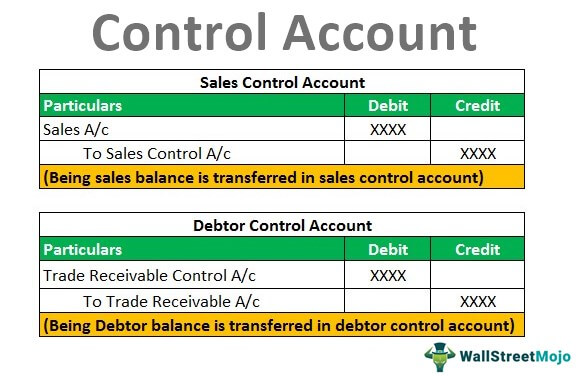

How to control accounts receivable. The company has a control account for all. Controls over accounts receivable really begin with the initial creation of a customer invoice, since you must minimize several issues during the creation of. If someone wanted to see detailed information for accounts receivable or accounts payable, they could.

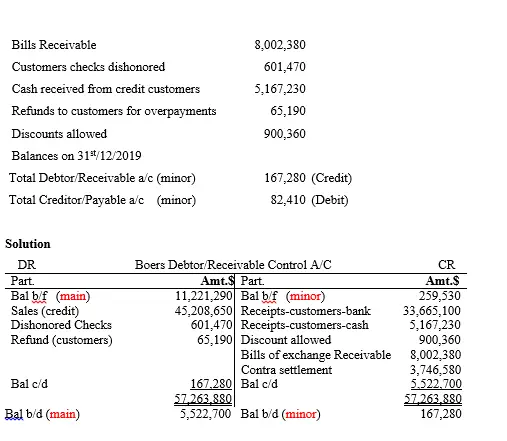

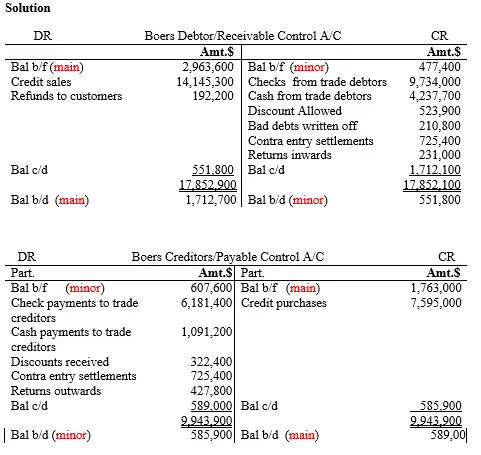

Typically, it boils down to four simple steps: Trade receivable for the period stands at $10000 in different debtors’ accounts, and trade payable stands at $ 20000 in different creditors’ accounts. Accounts receivable turnover ratio = net credit sales / average accounts receivable.

How to improve accounts receivable will sometimes glitch and take you a long time to try different solutions. One reason accounts receivable balances get out of control are because billing policies are. Compare the accounts receivable ledger account (s) to the customer aging report.

The first step of building an effective accounts receivable process is formalising a clear, internal credit control procedure. Be sure you have the ability to produce an accounts receivable invoice for your customers immediately. Loginask is here to help you access how to improve accounts receivable.

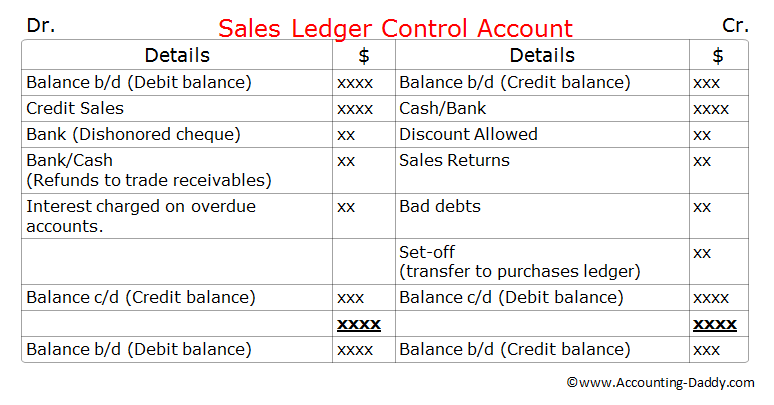

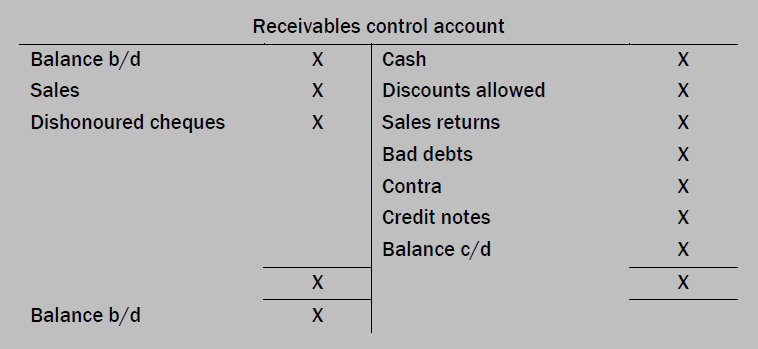

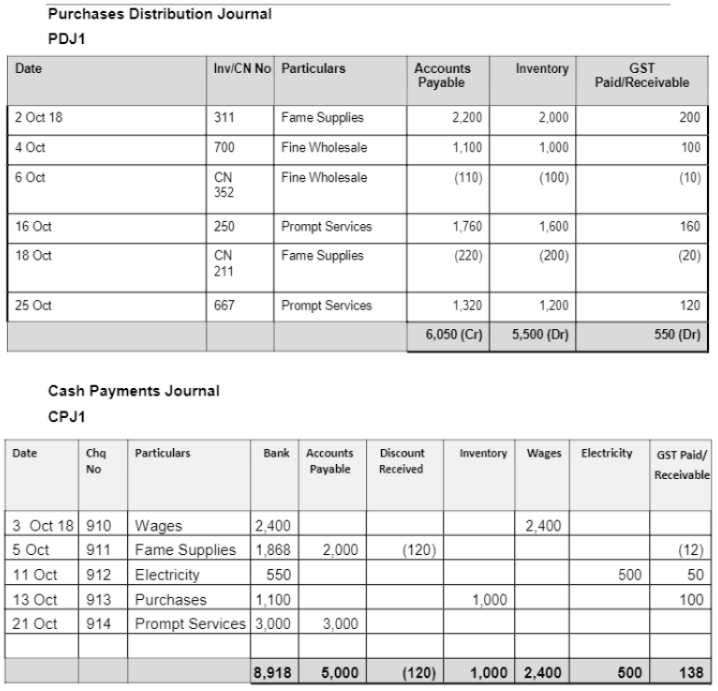

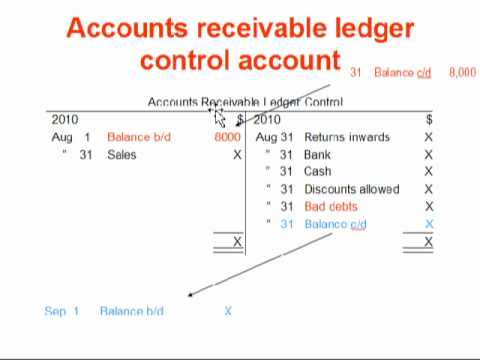

5 simple ways to control your accounts receivable establish billing policies. The accounts receivable control account or sales ledger control account, is an account maintained in the general ledger used to record summary transactions relating to. The first tip for you to be able to carry out a good control of accounts payable and receivable is to record each transaction.

Create an invoice for your customers. The formula for calculating the accounts receivable turnover ratio is: Produce an aged accounts receivable report and review the balances, particularly on large and overdue accounts.

In the case of accounts payable, it is. Accounts receivable is the amount of debts owed to the enterprise by legal entities and individuals who are its debtors. Have a strict credit control procedure for collecting.

The reconciliation of accounts receivable is the process of matching the detailed amounts of unpaid customer. Monitor unapplied cash receipts for timely resolution. How to reconcile accounts receivable.

How to control accounts receivable: The accounts receivable workflow process is similar at each company.