Matchless Info About How To Find Out Gst

14 rows the following table provides the gst and hst provincial rates since july 1, 2010.

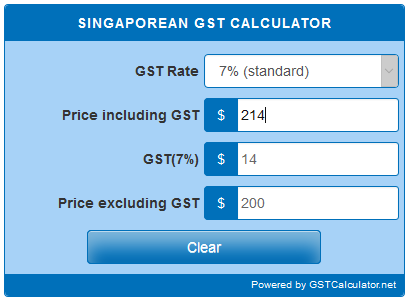

How to find out gst. How to find gst number (gstin) by name? Net amount (excluding gst) $90.91. $300 is gst exclusive value.

By validating pan number you entered, you will get the. You need to fill the gst number of person and click on. To get the the details of the company using gst number search using pan number, first enter the pan number of gstin you want search.

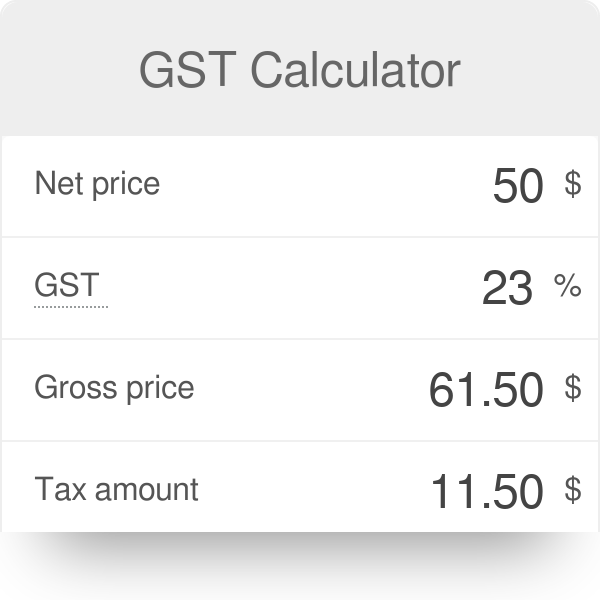

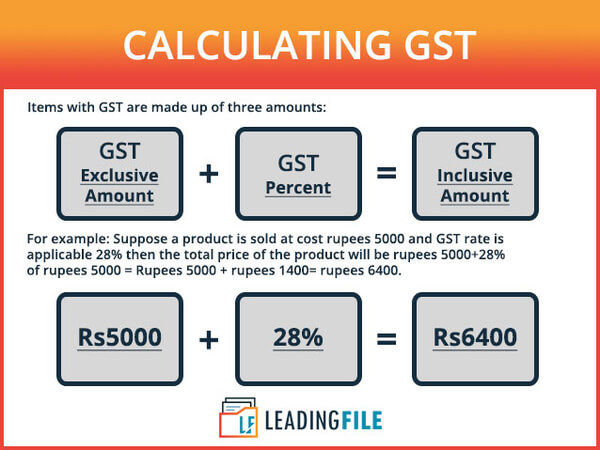

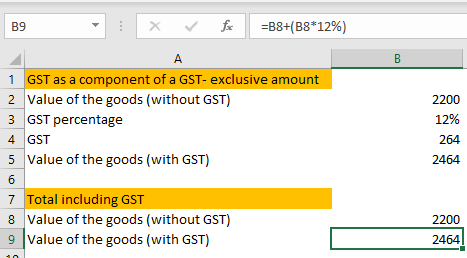

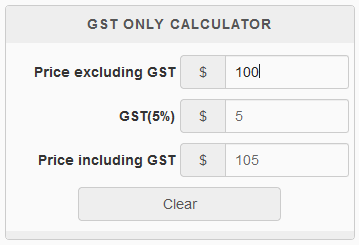

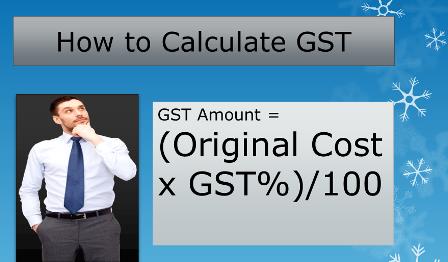

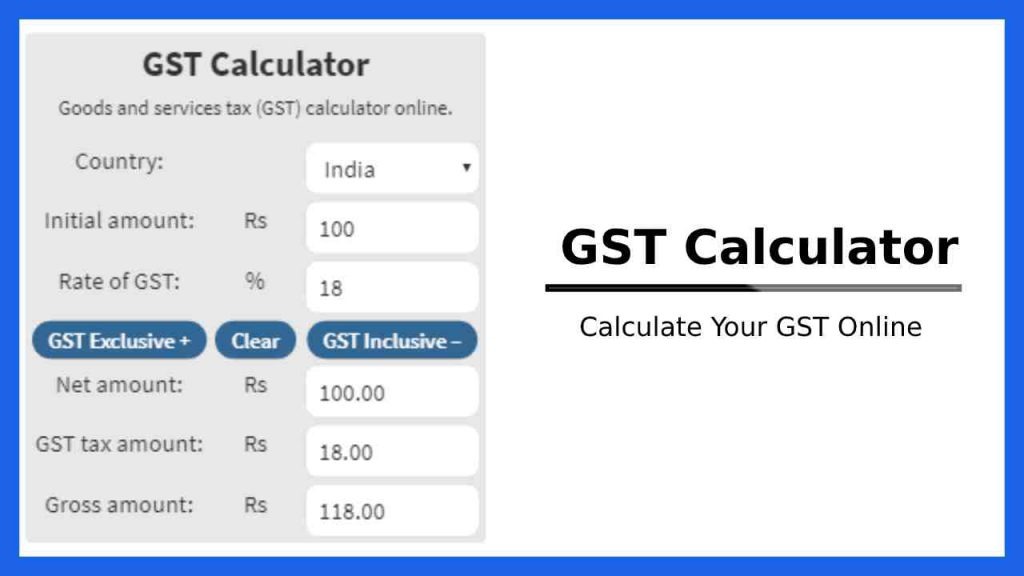

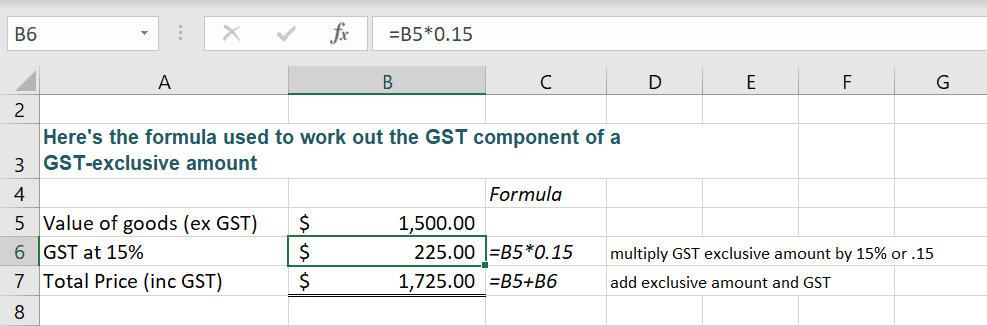

To figure out how much gst was included in the price you. We all know that the formula for finding gst amount is = supply value x gst%. Gross amount (including gst) $100.00.

Just multiple your gst exclusive amount by 0.15. $300 is gst exclusive value. For calculating gst, a taxpayer can use the below mentioned formula :

The rate you will charge depends on different factors, see: Open the masters india website: To work out the cost including gst, you multiply the amount exclusive of.

• enter the correct name of the business • type at least 10 characters to find relevant gst number information. Goods & services tax (gst) | services. $300 is gst exclusive value.

To find correctly calculate gst and gst exclusive amount from the total gst inclusive figure, we’ll use inland revenue’s. To calculate new zealand gst at 15% rate is very easy: $300 * 1.07 = $321 gst.

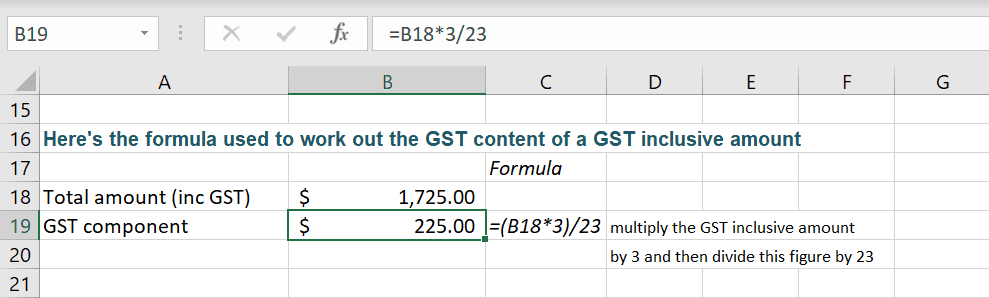

To know your gst check status at masters india’s gst portal check, you need to follow these few easy steps mentioned below: To calculate the gst amount from these figures, we will use this formula: Gst inclusive price x 3 ÷ 23 = gst amount.

In order to add gst to base amount, add gst gst amount = ( original. For instance, the total amount is $600, and the. Adding 10% to the price is relatively easy (just multiply the amount by 1.1), reverse gst calculations are quite tricky:

To get gst inclusive amount multiply gst exclusive value by 1.07; Type state name with few characters of name to find. This calculator can help when you're making taxable sales only (that is, a sale that has 10 per cent gst in the price).