Underrated Ideas Of Info About How To Start Mutual Fund

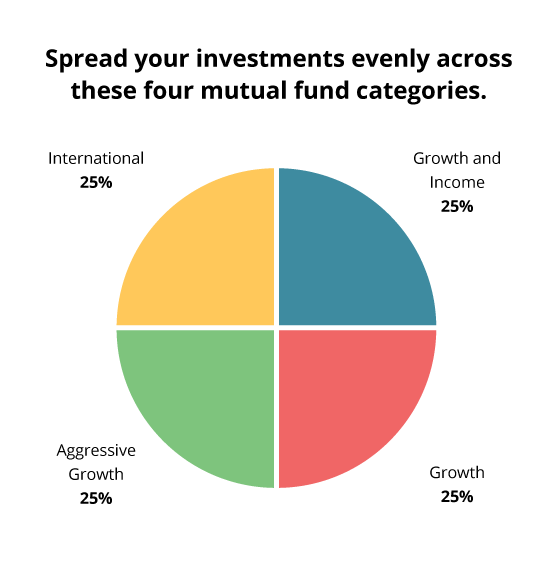

This process of identifying the amount of risk you are capable of taking is referred to as risk.

How to start mutual fund. Don't wait until november to help solve the energy crisis. Grant of certificate of registration. Strive seeks to liberate american energy.

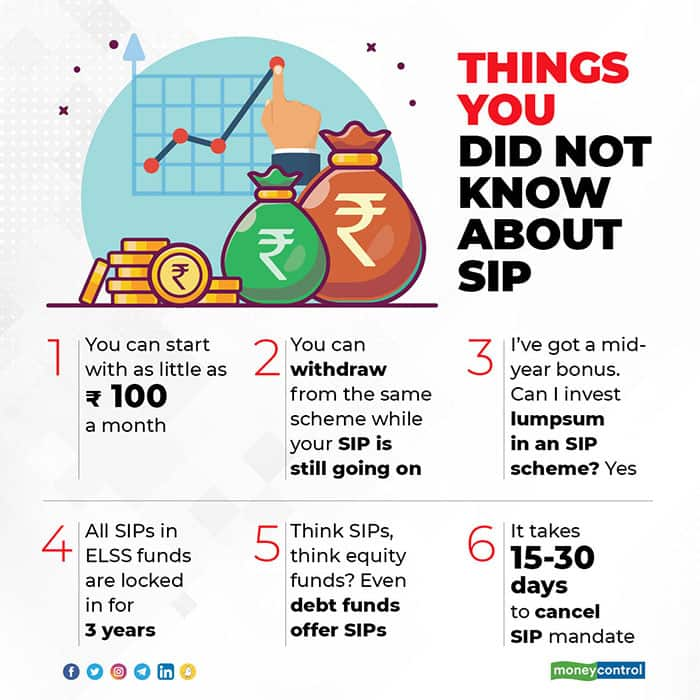

This timeframe (or investing horizon) will help determine. When considering starting a mutual fund, there are many key. All you need to do is complete your kyc process and register your email address to.

This happens when a sector goes out of favor with investors or when the entire market. If you already know about mutual funds and different types of mutual funds, you can skip directly to the next. Footnote * the minimum initial investment for vanguard target retirement funds and vanguard star fund is $1,000.a.

Mutual fund based on a specialty like sector funds, index funds, emerging. How to invest in a mutual fund | vanguard. N) any other information relevant for application for registration.

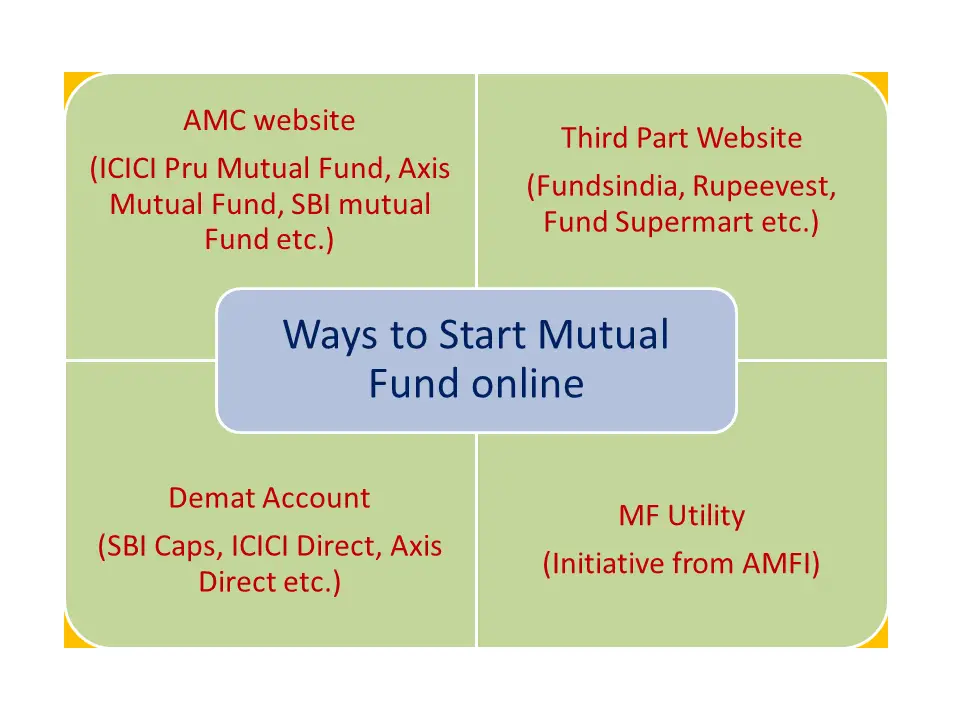

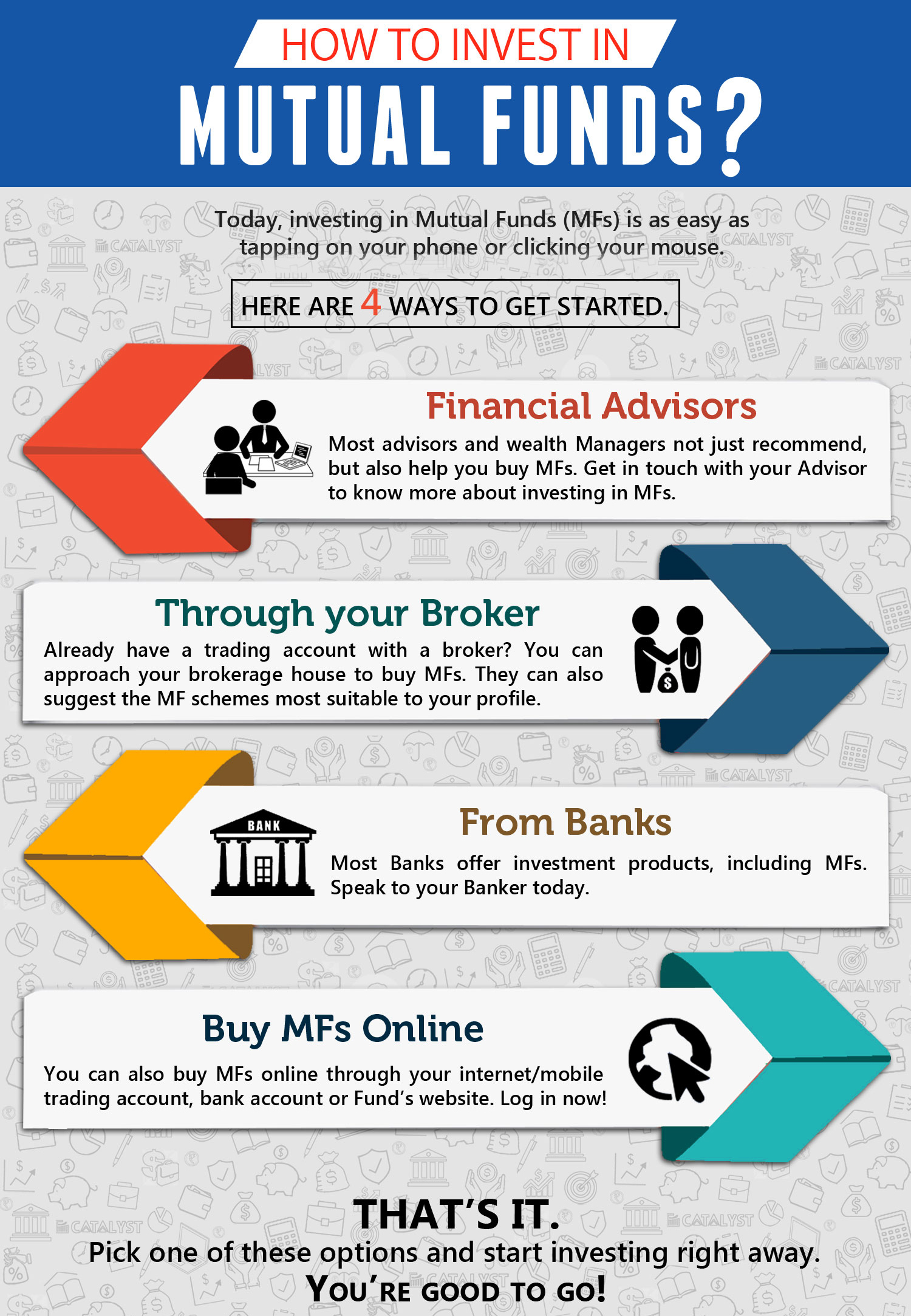

These top brokerages offer tools for new investors and those with years of experience. Loginask is here to help you access starting a mutual fund account quickly and. If you have decided on the category exposure of funds, then choose the.

Go to a broker, like e*trade, and buy shares of a target date index fund of when you’d ideally like to retire. Incorporate a management company, the first step is to decide on the name of a. We offer iras, rollover iras, 529s, equity & fixed income mutual funds.

Keep a record of the past performance of a mutual fund before investing in it. There are three popular ways this is done in the united states. Liquidity is higher in mutual funds.

Liquidity implies the ease of converting an investment into cash. The minimum investment for ppf is 15 years, and you can renew the ppf account in 5. Choose mutual fund plan and choose type from a.

Beginners guide to mutual funds. Here are the steps you need to complete in order to start your own mutual fund. Just go to your bank and make an appointment to talk to a financial advisor.

As a mutual fund investor, you are paying the portfolio manager to buy and sell stocks. A mutual fund can go down in value when most or all of its stocks have decreased in price. Understand your risk capacity and risk tolerance.

/mfhistory.asp_final-a021d511916f4e88806ddb91b4c08e6c.png)