Supreme Info About How To Avoid Paying Taxes In Canada

30 ways to pay less income tax in canada for 2022.

How to avoid paying taxes in canada. How to avoid canada’s capital gains tax. By taking the time to plan and divide your assets, draft a will, and think about how to avoid estate tax in canada, you can minimize the amount of taxes looming over your family’s. You can offset capital losses against capital gains in canada to reduce your overall tax bill.

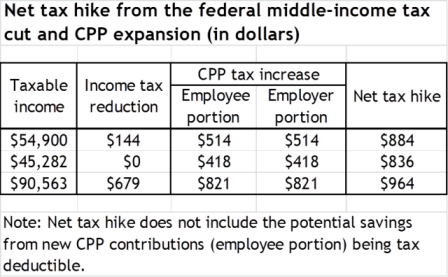

Put your earnings in a tax shelter. Structure your investment accounts to place us stocks that pay. However, there are maximum contributions for.

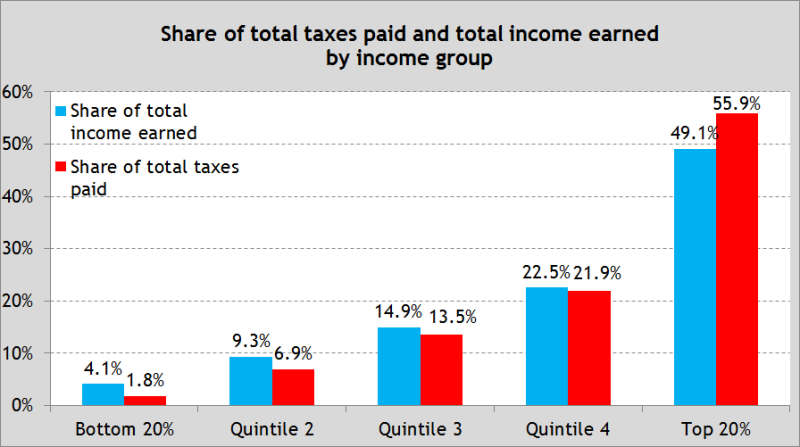

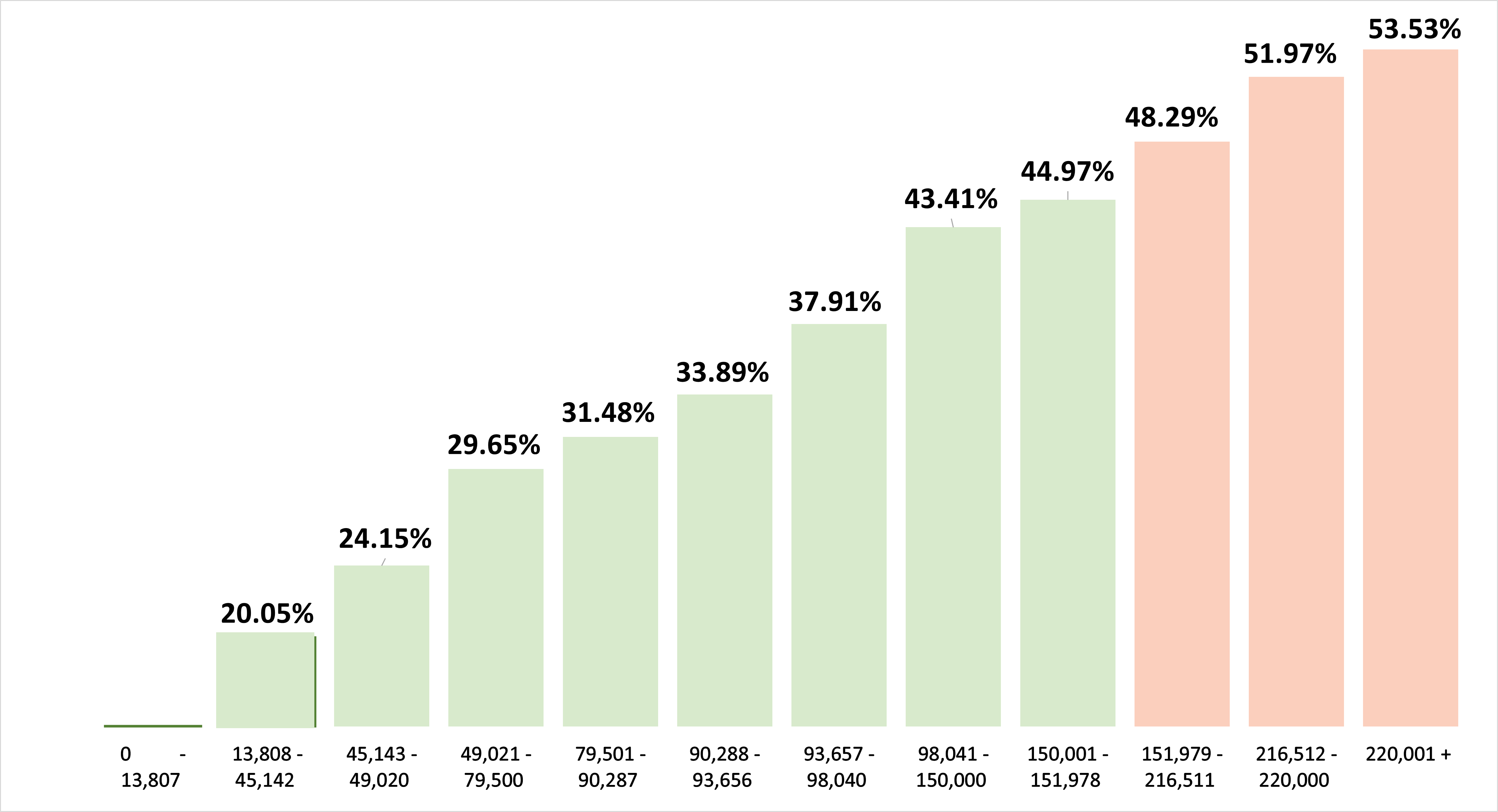

Tax shelters act like an umbrella that shields your investments. The most commonly used way on how to pay less income tax in canada is by maximizing your retirement savings. Canadian tax law allows for several ways to reduce your taxes owed if you know the current rules and can take advantage of them.

Take advantage of your registered retirement savings plan (rrsp) maximizing your rrsp contributions for the year is one sure. How can rich people legally avoid paying taxes? Everybody knows that rrsp contributions are tax deductible.

Assets that are passed on to someone else after you die are subject to deemed. 6 ways to avoid capital gains tax in canada 1. If you don't want to pay personal tax, then avoid taking money out of the corporation.

So for example, say you made a $500 gain from selling eth and a $500 loss from selling btc, these. A tax haven is a place where your. How to avoid estate tax in canada method 1 deemed disposition taxes.

3 ways to legally avoid taxes in 2020 buy a home for the first time. Invest money in a tax shelter. How do we avoid this?

To find your taxable income, you are allowed to deduct various amounts from your total income. .you can still start right now, acquire assets, get passive income and eventually, be able to avoid paying taxes because of the next tip. If you have no tax.

Make sure to settle all your tax obligations before leaving canada. Settle all your canadian tax obligations before you cease to be a canadian resident. Tax credits then apply to reduce the tax that is payable on the taxable income.

Hsa deductions are excluded from taxable income. You might think of tax shelters as a canopy for your assets. The way to avoid paying taxes legally is by opening a health savings account.

/https://www.thestar.com/content/dam/thestar/business/2022/06/28/canadians-failed-to-pay-1112-billion-in-federal-taxes-over-four-years-cra-study/canada_revenue_agency.jpg)